Storing an RV or motorhome during winter is about more than just parking it and waiting for warmer weather. Cold temperatures, snow, ice, moisture, and long periods of inactivity can create serious risks. Many owners assume that once their RV is stored, insurance no longer matters. In reality, winter storage is one of the most critical times to review and adjust your RV and motorhome insurance.

The right insurance strategy during winter storage can protect your investment, prevent costly damage, and help you avoid coverage gaps. This guide explains how RV and motorhome insurance works during storage, what coverage you need, and how to reduce risks and insurance costs without sacrificing protection.

Why Winter Storage Requires Special Insurance Attention

RV and motorhome claims often occur when vehicles are not being driven. Fires, weather damage, theft, vandalism, and water intrusion are common during storage months. Insurance policies are designed to cover these risks, but only if your coverage is structured correctly.

Winter storage changes how your RV is used, and insurance companies may adjust coverage expectations accordingly. Understanding these changes helps ensure your policy continues to protect your RV throughout the off-season.

Understand What RV Insurance Covers During Storage

RV and motorhome insurance generally includes several types of coverage that remain active even when the vehicle is not in use.

Comprehensive Coverage

Comprehensive coverage protects your RV against non-collision risks such as:

- Fire or smoke damage

- Theft or vandalism

- Storm damage from snow, ice, or wind

- Falling objects such as tree branches

- Damage caused by animals

This is the most important coverage to keep during winter storage.

Liability Coverage

Liability coverage may still be required, even when the RV is not being driven. It protects you if your stored RV causes damage or injury, such as rolling, collapsing structures, or fuel leaks.

Collision Coverage

Collision coverage is usually not needed during storage unless your RV is moved. Some owners choose to reduce or remove this coverage temporarily, depending on policy options.

Ask About Storage or Lay-Up Insurance Options

Many insurance companies offer a storage or lay-up option for RVs and motorhomes. This allows you to reduce certain coverages while keeping essential protection in place.

Benefits of Storage Coverage

- Lower insurance premiums during winter months

- Continued protection against theft and weather damage

- No coverage lapse while the RV is stored

- Easy reactivation when travel season returns

Storage coverage typically pauses driving-related protections while maintaining comprehensive coverage.

Do Not Cancel Your RV Insurance During Storage

Canceling your insurance entirely may seem like a cost-saving move, but it can create serious problems.

Risks of Canceling Coverage

- No protection against fire, theft, or storm damage

- Financial responsibility for all losses

- Higher premiums when restarting coverage

- Potential policy restrictions later

Maintaining continuous insurance coverage is almost always the safer and more cost-effective choice.

Choose the Right Storage Location and Tell Your Insurer

Where you store your RV affects both risk and insurance coverage. Insurance companies may consider storage location when determining premiums and claim eligibility.

Common Storage Options

- Indoor storage facilities

- Outdoor storage lots

- Driveway or private property storage

- Covered RV shelters

Indoor or secured storage often reduces risk and may qualify for lower premiums. Always notify your insurance provider if your storage location changes.

Protect Your RV to Reduce Insurance Claims

Insurance is essential, but prevention matters just as much. Taking the right steps to protect your RV during winter storage can reduce the chance of damage and claims.

Weather Protection

- Use a breathable RV cover

- Seal windows and roof openings

- Protect plumbing from freezing

- Remove snow accumulation when safe

Fire and Electrical Safety

- Disconnect batteries if recommended

- Shut off propane systems

- Inspect wiring before storage

Theft and Vandalism Prevention

- Use wheel locks or hitch locks

- Install security cameras or alarms

- Remove valuables and personal items

Reducing risk can help keep insurance costs lower over time.

Review Personal Property Coverage

Many RV insurance policies include coverage for personal belongings stored inside the vehicle. However, limits may be lower than expected.

Items That May Need Extra Coverage

- Electronics

- Tools

- Camping equipment

- Sports gear

If valuable items remain in your RV during storage, consider increasing personal property coverage.

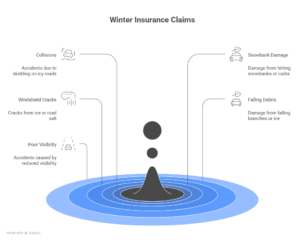

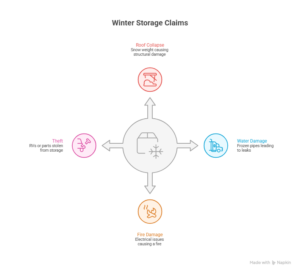

Understand How Claims Work During Storage

Knowing how claims are handled during winter storage helps avoid delays.

Common Winter Storage Claims

- Roof collapse due to snow weight

- Water damage from frozen pipes

- Fire caused by electrical issues

- Theft of stored RVs or parts

Document the condition of your RV before storage with photos. This can help support claims if damage occurs.

Check Deductibles and Coverage Limits

Deductibles and coverage limits apply even during storage. Review these details carefully.

Tips for Managing Deductibles

- Choose a deductible you can afford

- Understand whether storm damage has a separate deductible

- Balance premium savings with out-of-pocket risk

Adjusting deductibles can help manage costs while maintaining protection.

Update Your Policy Before and After Storage

Life changes, and so does your RV usage. Policy updates ensure your coverage stays accurate.

Update Your Policy If

- You change storage locations

- You add upgrades or accessories

- You install security features

- You remove or store valuable items elsewhere

When spring arrives, notify your insurer before using your RV again to restore full driving coverage.

Why Working With a Knowledgeable Insurance Provider Matters

Not all insurance companies treat RV storage the same way. A knowledgeable provider can help you:

- Choose the right storage coverage

- Avoid unnecessary costs

- Prevent coverage gaps

- Understand policy exclusions

- Reactivate coverage smoothly

Professional guidance helps ensure your RV remains protected year-round.

Final Thoughts: Smart Insurance Planning for Winter RV Storage

Winter storage is not a break from responsibility. It is a time when your RV or motorhome may be more vulnerable than ever. The right insurance strategy protects against weather damage, theft, fire, and unexpected losses while keeping costs under control.

By maintaining comprehensive coverage, using storage options wisely, protecting your RV physically, and reviewing your policy regularly, you can enjoy peace of mind throughout the winter months.

Smart insurance planning during storage means your RV will be ready and protected when the travel season returns.