Winter brings snow, ice, freezing rain, and low visibility. These conditions make driving more dangerous and increase the chance of accidents. Because winter is one of the busiest seasons for insurance claims, every driver should understand how auto insurance works during cold weather and what steps can help reduce risk and costs.

This guide explains how winter driving affects auto insurance, what coverage matters most, and how drivers can stay protected when roads are slippery and unpredictable.

Why Winter Driving Is Riskier

Cold weather changes how vehicles and roads behave. Ice reduces tire grip, snow hides road markings, and darkness arrives earlier in the day. Even careful drivers can lose control in winter conditions.

Common winter driving risks include:

- Sliding on ice or packed snow

- Longer stopping distances

- Reduced visibility from snow and fog

- More frequent fender benders

- Multi vehicle accidents during storms

Because accidents increase in winter, insurance companies see more claims during this season.

How Winter Affects Auto Insurance Claims

Winter weather does not change your policy, but it does increase the chance that you will need to use it. Insurance companies handle many types of winter related claims.

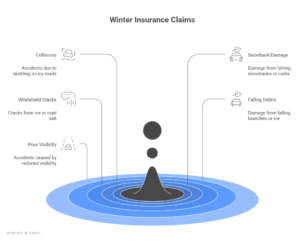

Typical winter claims include:

- Collisions caused by skidding

- Damage from hitting snowbanks or curbs

- Cracked windshields from ice or road salt

- Damage from falling branches or ice

- Accidents caused by poor visibility

Understanding which parts of your policy apply can prevent surprises after an accident.

Coverage Types That Matter Most in Winter

Not all insurance coverage protects against winter risks. Knowing what each coverage type does helps drivers choose better protection.

Liability Coverage

Liability coverage pays for damage or injuries you cause to others. If you slide on ice and hit another vehicle, liability coverage helps cover their repair and medical costs.

Collision Coverage

Collision coverage pays for damage to your own vehicle after an accident, regardless of fault. This is especially important in winter when skidding accidents are common.

Comprehensive Coverage

Comprehensive coverage protects against non collision damage such as falling ice, snow related tree damage, or cracked windshields caused by cold weather.

Roadside Assistance

Winter breakdowns happen more often. Roadside assistance can help with towing, dead batteries, or getting stuck in snow.

Does Insurance Cover Sliding on Ice

Yes, insurance can cover accidents caused by ice, but fault still matters. If your car slides and hits another vehicle or object, the accident is often considered preventable. That means your collision or liability coverage would apply.

Insurance companies expect drivers to adjust speed and driving habits for winter conditions. Even when roads are icy, drivers may still be held responsible.

Winter Driving and Fault Determination

Many drivers assume bad weather excuses accidents. In reality, insurance companies focus on driver behavior.

Factors insurers consider include:

- Speed for road conditions

- Following distance

- Use of headlights

- Vehicle maintenance

- Driver attention

Driving too fast for icy roads may result in fault, even if the weather is poor.

How Winter Accidents Affect Insurance Rates

Any at fault accident can increase insurance premiums. Winter accidents are no exception.

Rate increases depend on:

- Accident severity

- Claim amount

- Driving history

- Number of prior claims

Drivers with clean records may see smaller increases. Multiple winter claims can have a stronger impact.

Steps Drivers Can Take Before Winter Starts

Preparation reduces risk and may help prevent claims.

Review Your Coverage

Check that collision and comprehensive coverage are active if your vehicle has value.

Adjust Deductibles

Make sure deductibles are affordable if a winter accident occurs.

Update Contact Information

Fast claim handling depends on accurate details.

Add Roadside Assistance

This is helpful during snowstorms and freezing temperatures.

Safe Driving Tips That Can Lower Risk

Insurance companies encourage safe winter driving habits. Avoiding accidents keeps premiums stable.

Helpful winter driving tips include:

- Slow down and increase following distance

- Avoid sudden braking or sharp turns

- Use winter tires if possible

- Keep headlights clean and on

- Clear snow and ice from your vehicle

Safer driving reduces the chance of filing claims.

Vehicle Maintenance and Insurance Claims

Poor vehicle condition can affect claims. Worn tires, broken lights, or poor brakes increase accident risk.

Maintaining your vehicle helps with:

- Better control on icy roads

- Improved visibility

- Reduced breakdowns

Some insurers may question claims if neglect contributes to an accident.

Parking Risks During Winter

Winter damage does not only happen while driving.

Parked vehicle risks include:

- Falling ice or snow

- Plow damage

- Tree branches breaking under snow

- Sliding vehicles hitting parked cars

Comprehensive coverage typically handles these claims.

What to Do After a Winter Accident

If an accident happens, take these steps:

- Ensure everyone is safe

- Call emergency services if needed

- Take photos of vehicles and road conditions

- Exchange information

- Report the claim promptly

Documenting winter conditions helps with claim evaluation.

Winter Insurance Myths to Avoid

Some common misunderstandings cause problems during claims.

Myth: Weather automatically excuses accidents

Truth: Drivers are expected to adjust to conditions

Myth: Comprehensive coverage covers all winter accidents

Truth: Collision coverage handles crashes

Myth: Small accidents do not affect rates

Truth: Any claim may impact premiums

Knowing the facts helps drivers make better decisions.

Final Thoughts

Winter driving increases risks, but the right auto insurance coverage helps protect drivers from financial loss. Understanding how insurance applies during winter, choosing proper coverage, and practicing safe driving habits make a big difference.

By reviewing policies before winter arrives and driving carefully in snow and ice, drivers can reduce claims, avoid rate increases, and stay confident on the road during the coldest months of the year.